Refinance home loan borrowing calculator

Mortgage refinance is the process of replacing your current mortgage with a new loan. Conventional and FHA lenders allow you to borrow up to a maximum 80 loan-to-value LTV ratio.

Usda Home Loan Qualification Calculator Freeandclear

If you were to refinance your home with a new loan amount of 160000 youd get to pocket 60000 minus closing costs and fees.

. Comparison rate on the Australian Mutual Bank Basic Variable Home Loan for LVRs. To take cash out you usually need to leave 20 equity 40000 in the home. What does it cost to refinance a home loan.

To pay for renovations a deposit on a second house etc. Want to find out much you can borrow for a home loan. Loan-to-value ratio LTV is the percentage of your homes appraised value that is borrowed - including all outstanding mortgages and home equity loans and lines secured by your home.

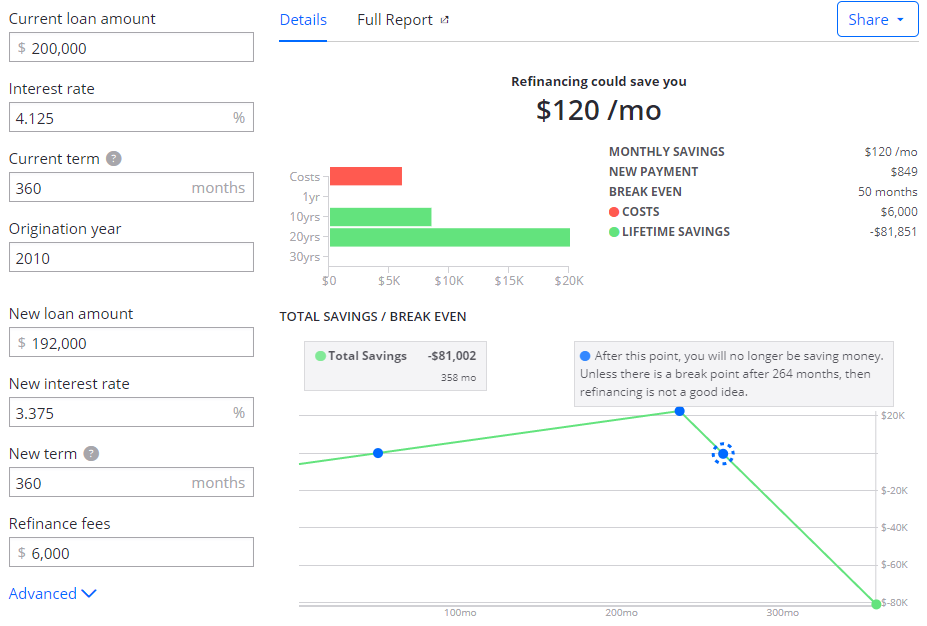

With NerdWallets free refinance calculator you can calculate your new monthly payment and estimate your monthly and lifetime savings. Backed by the Commonwealth Bank. For information on how these results are calculated details are listed on our borrowing power calculator assumptions page.

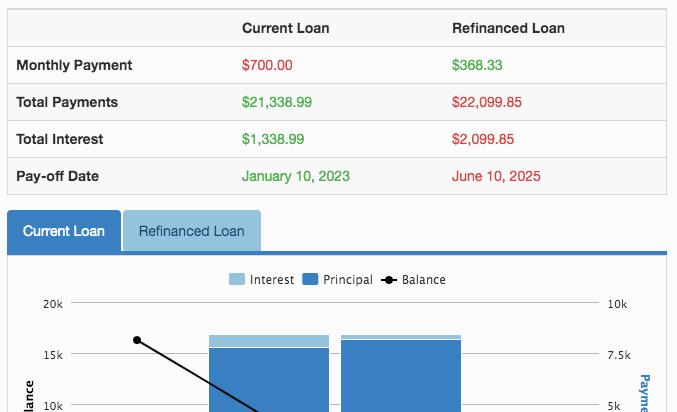

For example a lenders 80 LTV limit for a home appraised at 400000 would mean a HELOC applicant could have no more than 320000 in total outstanding home. Refinance home loan rates of note in September. The first portion of the mortgage refinance calculator requires input of current numbers like monthly payment loan interest rate and remaining balance and term.

Whether youre refinancing or just wanting to understand how much you can afford all you have to do is enter how the amount you would like to borrow interest rate home loan term payment frequency and repayment type either principal interest or. You can choose between the refinance first home and investing tabs to view results most relevant to you. The Loan term is the period of time during which a loan must be repaid.

It is a short-term loan that is eventually either paid back in full or refinanced into a conventional mortgageConstruction loans tend to be different from other types of loans because they require a plan and possibly a licensed constructor who would be involved in the. About home loan specialists. The information provided on this website is for general education.

Often people do this to get better borrowing terms like lower interest rates. A fee charged by your new lender to determine your. Refinancing can come with a range of costsSome of the fees you may have to pay include.

Our home loan borrowing power calculator could help you work out what you may be able to afford to borrow from a financial institution based on your income and expenses. With a VA cash-out refinance you can refinance your current mortgage regardless of whether its a VA loan or a conventional loan and get cash by borrowing against. A low-rate variable home loan from a 100 online lender.

Key fact sheets All Calculators. Some Australians do take on extra debt when refinancing as a way of borrowing more money eg. When you refinance your car loan you may receive a lower interest rate and save money on payments.

How much can I afford to borrow. VA cash-out refinance. How much do I have to pay.

If you wanted to refinance to a more suitable loan that had say a 15-year loan term an offset account and a lower mortgage rate then you would only have to refinance the remaining 400000. The equity requirement depends on what type of cash-out refinance youre borrowing. For example a 30-year fixed-rate loan has a term of 30 years.

Minimum amount of 500000 and LVR less than or equal to 80. Your home is worth 200000 and you owe 100000 on your mortgage. Our borrowing power calculator gives you an initial estimate of what a lender may be willing to lend you based on your income and expenditure.

Your maximum loan amount is based on your credit score and combined loan-to-value CLTV. Discover Home Loans offers loan amounts between 35000 and 300000. Use our home loan calculator to estimate what your monthly mortgage repayments could be.

With our home loan calculator calculate your home loan repayments and estimate the true cost of your mortgage including stamp duty insurance and more. Heres an example. What Is a Construction Loan.

Home loan borrowing calculator. Your LTV ratio is the percentage of your homes value that is financed by the loan. Use our borrowing calculator to work out how much you could borrow for a home loan to buy a house and what your home loan repayments might be.

Compare all Personal Loans. Bankrate reviewed and compared the best auto loan refinance rates. Use our home loan calculator to estimate what your monthly mortgage repayments could be.

An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan based. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. CLTV includes your home equity loan plus your current mortgage balance and must be below 90 of your homes value.

The results are sorted by current rate lowest to highest. Receive 3000 cashback when you refinance your home loan from another lender apply by 30 September 2022 settle by 31 December 2022 and open an Orange Everyday account within 70 days. A fee charged by your current lender to pay out your existing loan.

But youre also borrowing for a shorter time so you pay. Whether youre refinancing or just wanting to understand how much you can afford all you have to do is enter how the amount you would like to borrow interest rate home loan term payment frequency and repayment type either principal. Home loan borrowing calculator Home loan stamp duty calculator Mozo provides general product.

A fee charged by your new lender to make a new loan application. A construction loan involves borrowing funds to finance your home construction project. The information provided by this borrowing power calculator should be treated as a guide only and not be relied on as a true indication of a quote or pre-qualification for any home loan product.

Home loan repayment calculator. VA lenders allow up to a 90 LTV for cash-out refinances. 2000 cashback when you refinance to us If youre eligible and you apply to move your home loan to us by 28 February 2023 you could get less home load with 2000 cashback.

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Refinancing Your Reverse Mortgage How It Works Credible

Our Refinance Calculator Is It Time To Refinance Your Mortgage Moneygeek

Mortgage Calculator How Much Monthly Payments Will Cost

Va Mortgage Calculator Calculate Va Loan Payments

How Much A 350 000 Mortgage Will Cost You Credible

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

5 Year Fixed Mortgage Rates And Loan Programs

Home Loan Calculators And Tools Hsh Com

Mortgage Refinancing Calculator Crown Org

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Mortgage Calculator Money

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Downloadable Free Mortgage Calculator Tool

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

How Does Refinancing Work How And When To Refi Zillow